This post is for the majority—not the minority. I’m sure there’s a handful of people who were openly and sensibly taught about money management and finances as they came of age. Maybe your parents or guardians spoke to you about money, teaching you how to manage it, preserve it, and make it work for you. If you fall into this category, then unfortunately, this post isn’t for you.

However, I suspect the majority of you are still here. It’s rare for money to be openly spoken about within a household, let alone for valuable aspects of money management or finance to be taught. This lack of conversation contributes heavily to the financial illiteracy many of us carry into adulthood. Money remains a taboo subject. We don’t talk about it at home. We don’t learn about it at any stage of formal education. Yet ironically, money is what makes the world go round. It’s the reason we pursue degrees and seek employment—to earn the very thing we were never taught to understand or manage. Sounds crazy, right?

With the schooling system out of the question, our only real hope was to learn from our parents. But as we’ve established, that’s rarely the norm. Instead, we grew up learning about money through perception—based on what we saw and witnessed firsthand. You may recall memories of seeing your parents in financial distress, struggling with consumer debt built up through irresponsible use of credit cards and loans. As an adult, this may have made you fearful of ever touching a credit card or loan again. Which, to be fair, isn’t necessarily a bad thing.

On the other hand, maybe your parents used credit cards strategically—paying them off in full each month to build credit and secure better mortgage rates. If that was your experience, you might now understand how to navigate those tools to your advantage. I say all of this to emphasize: we are all products of our environment, and we may have inherited lessons from people who were simply playing the game wrong. Because of that, we often limit ourselves from the potential benefits of using the same tools correctly.

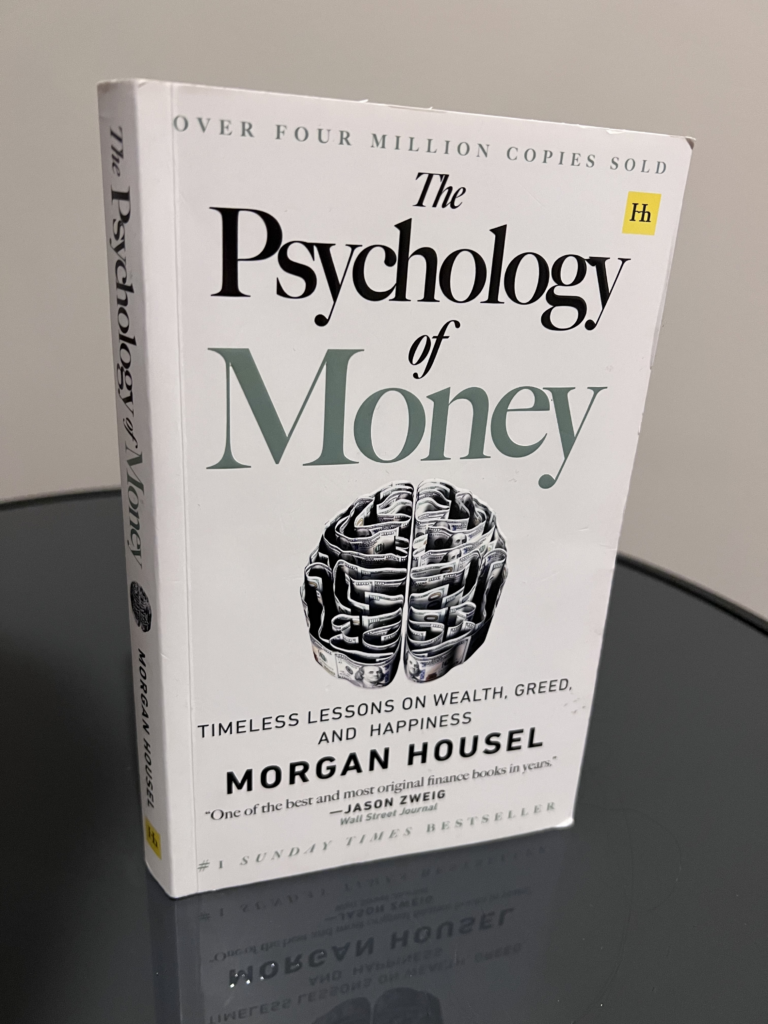

“Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.”

—Morgan Housel, The Psychology of Money

You’d be amazed how often we write something off just because someone else had a bad experience with it. We rarely stop to think whether that person made a mistake in how they approached the situation. Instead, we immediately form a judgment. The world is vast, and our experiences are limited. They don’t even begin to compare with the wealth of information and knowledge that exists out there.

So, let’s go over the top four ways you can break out of this inherited cycle and begin developing an unbiased, empowered view of money—so you can use it to your advantage or consciously choose to avoid certain things, free from fear or misinformation:

1. Face the Truth – Acknowledge Your Financial Shortcomings

The first step to solving any problem is admitting that it exists. Once acknowledged, we can begin to think objectively about how to solve it.

It’s also important to remember: no parent is perfect. They all do their best. Avoid resentment for the lack of knowledge you were exposed to or for mistakes you may have made as a result.

Next, Grab a pen and paper (yes, literally—writing things down makes it more impactful) and list every financial rule you currently live by, whether good or bad. Also, write down every belief you hold about money—positive or negative. Here are a few examples you might write:

- I believe consumer debt is okay to fund my wants and desires

- I don’t know how to save or budget

- I don’t understand investing and don’t know where to start

- All debt is bad debt

- I only know how to live paycheck to paycheck

- I’m scared of money and don’t know how to manage it

- I spend impulsively and make emotional financial decisions

- Whenever I get money, I find a way to spend it

These are all very common—I believed and followed some of them myself before I began my own financial education. But once written down, you can now see the problem areas clearly—and attack them with intent if needed.

2. Begin Your Financial Education—Tailored to Your Beliefs and Habits

The great thing about the world we live in today is that everything is available to us at the click of a button. All the information you could ever need on any topic is accessible — and it’s mostly free. So there’s really no excuse.

Books, blogs, YouTube, even TikTok — all of these platforms, when used correctly, can educate you about money if the advice comes from the right sources. Please don’t fall into any scam traps or pay anyone just yet — there’s plenty of free, high-quality content out there. And anyone claiming to grow your money exponentially for you — well, let’s just say that’s likely too good to be true.

Your biggest asset is your mind, and the best fuel you can give it is information and knowledge. Never stop learning.

Make it your intention to learn everything you can about the areas of money you struggle with. Become obsessed with it. And more importantly, apply what you learn to your life.

Let’s go back to the example of “all debt is bad.”

As a child, maybe you saw your parents drowning in debt and constantly stressed. That experience made you fearful. They may have told you to never touch a credit card. Now, that’s not necessarily bad advice — but if you dig a little deeper, you’ll learn that credit cards can actually be used strategically to increase your credit score.

For example, you can get a credit card, make one small purchase each month (something you would’ve bought anyway, like petrol), and set it up to automatically pay off in full and on time. Boom — you’ve just used a tool that you once feared to your benefit.

This was just an example. Do some research and investigation on your individual sticking points. You don’t know how to invest? Learn the different and available opportunities which may suit you.

You don’t know how to save or budget? Learn the best methods and utilise tools to improve this matter.

Whatever it is, you can find an answer which works for you.

3. Apply Practical Changes: Start Small and Build Over Time

Once you’ve absorbed the information and feel confident, it’s time to take action. This part is different for everyone—but the principle is the same: start small and stay consistent.

Make the commitment to yourself that for each particular goal or objective you have set yourself that you will begin applying your change in a slow manner. Plan it out and be intentional with it so you will actually get it done.

Let’s say you’ve just overcome your fear of credit cards. Your first step might be applying for a beginner card with a low limit. Use it once a month for a small purchase, like groceries or gas (Something you were going to purchase regardless), and set it to autopay in full every month. After six months of doing this, you’ll see your credit score rise—and your financial confidence will grow alongside it.

It’s important to understand that credit cards and debt can be very bad when used irresponsibly, however this is where you must be mature about how you use these tools and hold yourself accountable in order to avoid any mistakes.

Maybe you are someone who lives pay check to pay check and has no savings to their name. At the end of the month you find your bank balance very close to zero as you count down the days to pay day so you can breathe again. This could have stemmed from never being taught how to be disciplined enough to save or put money aside or to budget and live below your means so you can grow your nest egg.

After your research you will come across different methods and techniques to fix this. You make the decision to start slow to shift your financial habits so that you can sustain it for the long term. This may look like the following – going through the last 3 months of your bank statements and understanding what it is you actually spend money on. This may be a shock for some people because unless we pro actively check our accounts, we don’t realise just how much we are spending on unnecessary things such as subscriptions and eating out.

You may adopt a budgeting method such as the 50/30/20 rule:

- 50% for needs

- 30% for wants

- 20% for savings, investing, or debt repayment

That 20% means you’re finally paying yourself first—and that’s a powerful shift.

4. Break the Cycle for the Next Generation

Congratulations—you’ve taken control of your financial future. But here’s the most important part:

Don’t be stingy with what you’ve learned.

When it comes to the next generation—whether your kids, younger siblings, or mentees—pass it on. Be the example. Speak openly about money. Normalize the conversations you wish you’d had growing up.

Let’s finally break this cycle—for good.

Inspired by The Psychology of Money