I want you to be honest with yourself when answering the following question:

Have you ever made a financial decision with the intention of having a better public image in the eyes of your peers or everyone online?

If you’re like 99% of people, then the answer is most likely yes. If your answer was no, then give it some more thought. Think back to different things you’ve purchased… Can you wholeheartedly admit to yourself that you truly wanted this item without any other influencing factor?

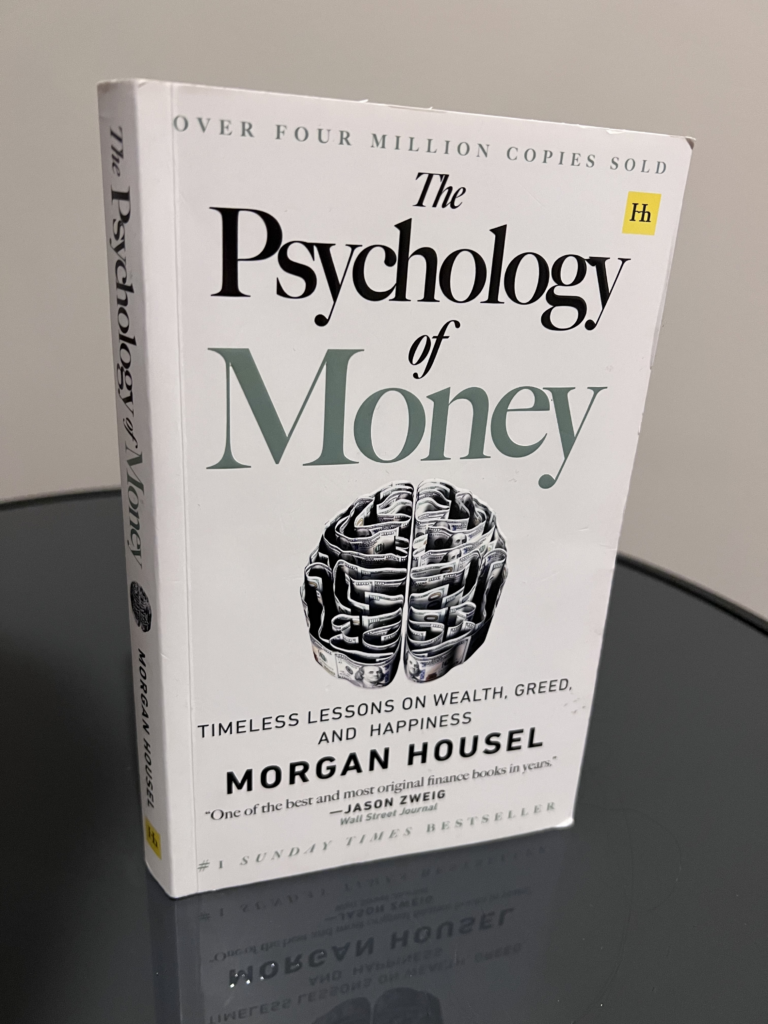

You may not even realise it in the moment—when purchasing something or making a decision—where the placement of that thought came from. This is a mistake so many people make, from teenage years all the way to adulthood, and it’s something that will prevent you from building wealth and getting ahead financially. In fact, I too have made these errors—until I read The Psychology of Money, which truly shifted my mindset and made me aware of how we think. Honestly speaking, if there were a scale from mild to severe, I would say the personal example I’m about to share with you tips heavily toward the severe side.

I was 23 years old and on the hunt for my ‘dream’ car—however, looking back now, I realise that social comparison made it my dream car. The truth is, I didn’t care about cars, but something in the back of my mind—when making my way to the car garage—told me that I needed a BMW… or at least something that would look cool and show everyone I could afford a car like that. But the truth is, I couldn’t afford the car. And I didn’t own it either.

The ‘F’ word—and not the one you’re thinking of… financing.

There was no way I could afford to buy a BMW outright, but the monthly payment was easily doable for me at that stage of my life. So what did I do? Took a 4-year lease deal for the BMW. Honestly, it felt good for the first few months, but the truth is, it wore off. And I realised one of the most valuable things I now carry with me:

No one cares about your possessions as much as you do.

To break the numbers down: the monthly payment was £290, and if we draw it out over 4 years, that would come to approximately £13,920. And on top of all that, I wouldn’t even get to keep the car at the end of the term—I’d have to pay a ‘balloon’ payment for the car to officially be mine.

Let’s, for talking sake, say that instead of getting the BMW, I had a bit more of a sensible head on my shoulders and bought a cheaper but reliable car outright for £6,000. That would have left me with an excess of around £8,000.

To take it a little further—£8,000 invested into, for example, a fund which tracks the S&P 500 over the span of 30 years, with an average return of 10% per year (which aligns with history), would equate to roughly £139,000.

Let that sink in.

An expensive fee for trying to play the part.

So let’s go over four ways in which we can combat this and start making better financial decisions that aren’t influenced by others:

1. What’s Your Why?

This might sound like a very basic tip, but hear me out. Our minds are constantly influenced by the social media algorithm every day. From viewing the ‘success’ of others on Instagram—flaunting the areas of their life they want us to see—to being exposed to every product imaginable that’s being advertised on our favourite platforms, our minds are always at work.

So to put it simply, the next time you feel the urge to purchase something—whether big or small—ask yourself twice why you want it. Will this make you genuinely happy? Or is there an ulterior motive behind the purchase, in that you want to gain some brownie points from your friends in real life and followers on social media?

It’s okay to admit the latter to yourself—and if so, have the discipline to say no to that voice in your head and move on.

It might sound simple, but thinking twice and giving your mind an opportunity to be truthful with itself might just be the accountability you need to shift your habits.

2. “The Man in the Car Paradox”

“No one is as impressed with your possessions as much as you are.” – Morgan Housel, The Psychology of Money.

Most people buy nice things because they think it will bring themselves more respect and admiration in the eyes of those watching. But this is far from the truth.

The reality is simple: when we see nice things—for example, someone driving a nice car—do we ever take more than a second to look at who is driving the car and analyse them? No. It’s the car we’re looking at, and most likely imagining ourselves in the driver’s seat.

Have you ever scrolled on social media and seen a photo of someone somewhere exotic that looks stunning? Do we care who the person is? No—we care about the location, imagine ourselves being there, and start planning our next holiday.

My point is: fancy things and luxuries don’t usually draw out admiration or respect from others—they draw out jealousy and desire in their own minds, and that’s where your part in the sequence ends.

So if your goal is to be respected and admired, it’s probably best to find a different means to get there.

3. Shifting Your Mindset: Assets vs. Liabilities

Understand that most of the time, when you buy something with the intention of impressing someone else, it’s usually a liability purchase. For example: expensive clothes, cars, and most forms of jewellery. Most of these items, once purchased, will go down in value and be worth less than what you paid for them.

Think about that for a second—you’d be spending your hard-earned money buying an item so that your perceived status increases (which we’ve already discussed is mostly an illusion), just for that item to depreciate and become worth less than what you bought them for.

Of course, there are always exceptions to the rule—such as certain jewellery pieces that can go up in value, or limited edition items that may sell for more down the line—but I would class these more as investments.

Understanding that the key to building wealth and becoming rich is by acquiring assets, not liabilities, is a great way to frame your thinking when making any purchase.

4. Don’t Judge a Book by Its Cover

Understand that the act of buying things to impress others or to look a certain way usually stems from the feeling of being behind or inadequate.

I don’t blame you—what else are you meant to think when you’re driving on the road and see dozens of German cars while you’re in a 1.2L engine car? How else are you meant to feel when you go on Instagram and see almost every follower on holiday in the Maldives?

The truth is, these are the thoughts that make us make silly financial decisions. We feel insecure and behind.

However, think of it this way:

You don’t know how many of those drivers have leased, loaned, or financed their car—and their monthly payment is almost half of their wage. You don’t know how many people you compare yourself to daily who fund their lifestyle with credit cards and loans just to portray an image.

Is this the case for everyone? No, of course not. There are many successful people who own their cars and make plenty of money to live a lavish lifestyle.

However, the truth is you can’t judge someone’s situation just by what you see—and you’ll never know the full details. Because it isn’t your business.

So my advice? Stop focusing on it in the first place.

Focus on yourself and what truly matters—and that is getting ahead financially.

To do this requires you to be intentional, to plan, and to be sensible.

Conclusion

Striving to impress others is one of the most expensive habits you can have. Not only does it affect you financially but also mentally and emotionally. Have a think of some of your most recent purchases you have made. Was it for you? Or for them? Would you buy it again? Just something to think about. Start here and watch how your mindset begins to shift.

Inspired by The Psychology of Money